The China Insurance Regulatory Commission (CIRC) recently released draft changes to the standards applicable to insurance company investors for industry comment, proposing to narrow equity investment ranges both for financial investors and for insurance companies, while broadening opportunity for strategic investment. If implemented, the new rules will directly apply to all prospective investors in domestic insurance companies, and will apply by reference to domestic investors in foreign invested insurance companies.

Background

On August 29, 2016, CIRC distributed a revised draft of the “Administrative Measures for Equity of Insurance Companies” (Amended Measures) for industry review, with a comment period that terminated on September 2, 2016. If adopted, the Amended Measures will supersede both the “Circular on Article 4 of the Administrative Measures for Equity of Insurance Companies” (promulgated by CIRC on April 9, 2013) and the “Circular on Limited Partnership Investing in Insurance Companies” (promulgated by CIRC on April 17, 2013). The Amended Measures are intended to directly apply to both public and privately held domestic insurance companies (i.e., a company wherein the equity interest held by domestic investors is greater than 75%), and are to be applied by reference to domestic investors in foreign invested insurance companies.

Investor Qualification Requirements

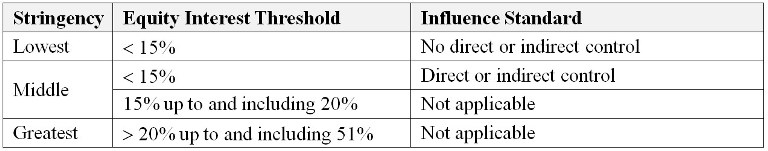

Historically, CIRC has categorized investors according to equity interest (aggregated together with affiliates) and influence over the company, imposing more stringent requirements for investors holding greater equity and/or exercising greater control over the company.

The current thresholds for different categories are summarized below.

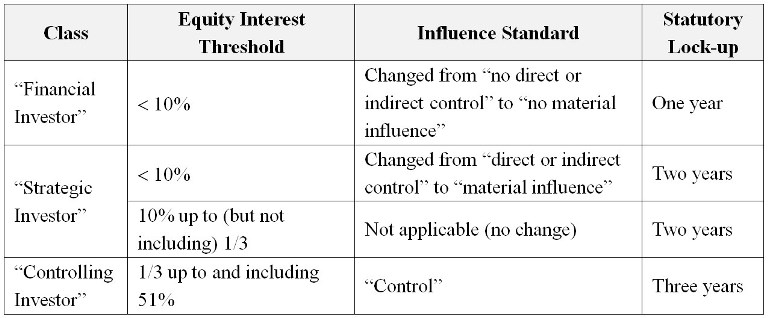

Pursuant to the Amended Measures, a new statutory lock-up period would be introduced, the classification categories would be formally labeled and, most significantly, revised thresholds for different categories would be adopted, as summarized below.

Note: Insurance companies would be restricted to investing in the most stringent category (i.e., “Controlling Investor”). Non-insurance company investors could apply for investment in any category.

Certain aspects of the Amended Measures are unclear. For example, the extent to which the Amended Measures will apply to domestic investors in foreign invested companies is not yet clear. The precise meaning of “material influence” is also unspecified, but appears to be aimed at establishing a new, lower threshold in comparison with the current standard of “direct or indirect control.”

Change of Indirect Investor

The current CIRC rules are silent as to whether a change of indirect shareholders is subject to CIRC approval. Pursuant to the Amended Measures, in the event that a direct or indirect controlling investor of either a Strategic or Controlling Investor proposes to transfer its controlling interest to another party, and such change may be deemed to deliver shares of the related insurance company, then such transfer will be subject to CIRC approval. This provision appears to indicate that CIRC approval is not required if the interest transferred is only a non-controlling interest.

Conclusions

CIRC’s draft changes to the standards applicable to domestic investment in insurance companies are an important milestone with potentially significant impact on all categories of investors, as summarized below.

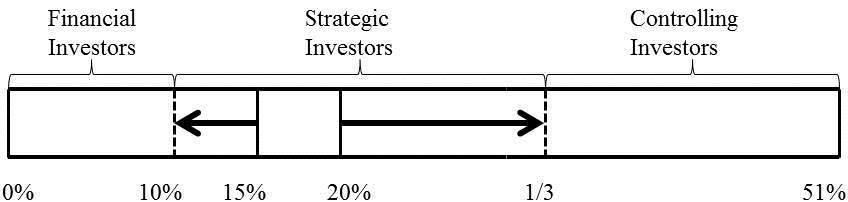

First: with respect to Financial Investors, the Amended Measures propose to narrow the applicable equity window and impose a lower investment cap, as well as the degree of permissible influence that a Financial Investor may exercise over the company.

Second: with respect to investors who are insurance companies, a higher minimum investment threshold would be imposed, narrowing the range of permissible investment.

Third: with respect to the middle category of Strategic Investors, the range of permissible investment would be materially increased, apparently providing enhanced opportunities for strategic investment by domestic investors, and allowing more flexibility.

Fourth: with respect to potential foreign investors in connection with the establishment of a joint venture insurance company, although the Amended Measures are not directly applicable to joint ventures, they would affect the selection of domestic partners and the framework of the company’s equity structure.

For further information, please contact:

Elsie Shi, Partner, Jincheng Tongda & Neal

elsieshi@jtn.com, (+86) 10 57068163

John Bolin, Senior International Counsel, Jincheng Tongda & Neal

johnbolin@jtn.com, (+86) 10 57068028

Nigel Xie, Associate, Jincheng Tongda & Neal

nigelxie@jtn.com, (+86) 10 57068157