The catalyst of a rising Chinese stock market along with the government’s implementation of favorable policies for Chinese companies has helped to spur China’s Internet and hi-tech companies to reconsider their dependence on foreign capital markets. They are now eager to begin the process of taking their companies private, and subsequently relisting on China’s domestic stock exchanges.

Recently, JT&N senior partner Guohua (Annie) Wu was interviewed by CCTV’s Channel for Economics and Finance, and subsequently contributed a second interview to Caijing Magazine regarding this important trend and the impending return of Chinese Internet and hi-tech companies to the domestic fold.

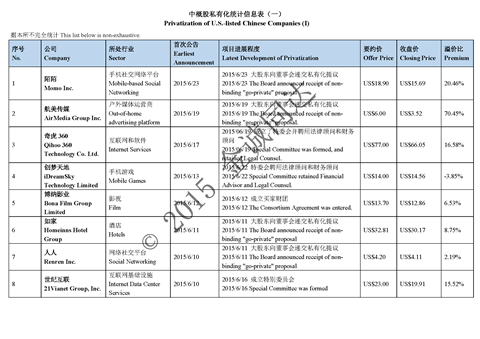

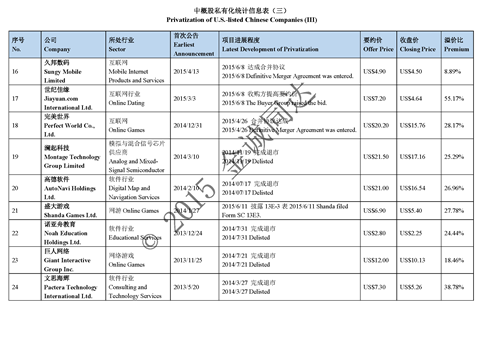

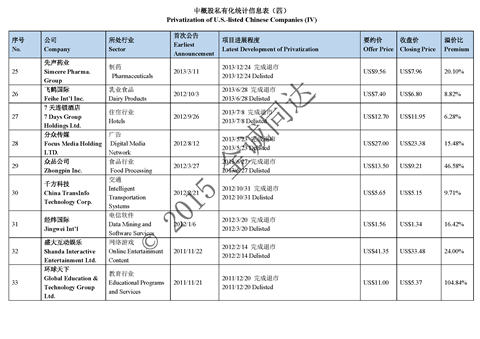

As of June 24th, 2015, a total of 24 out of nearly 200 U.S.-listed Chinese companies have received buy-out offers since the beginning of the year. This is a significant trend covering a broad spectrum of transactions. Ms. Wu’s legal team compiled detailed information to create a series of charts that clearly show the impact this is having on the market, as well as giving some ideas as to what we can expect in the coming months. (The detailed charts are available via the link below “Read More” or on our firm’s official site, http://www.jtn.com/5272.html.)

The interviewee, Ms. Guohua (Annie) Wu, is a senior partner at JT & N, heading the firm’s outbound investment practice. Her expertise encompasses cross-border investment, M&A and capital markets.

In 2013 and 2015, Ms. Wu was named twice as a finalist of the PRC Dealmaker by ALB, a renowned institution for legal rankings; she has also been named as an Asialaw Leading Lawyer in corporate/M&A practice since 2014 by Asialaw Profiles.

The two interviews in June provided the audience with Ms. Wu’s insights into what to expect as more Chinese firms seek out the advantages available to them by transitioning to the domestic Chinese equity markets.

The interviews, which will be integrated into a TV program and an article respectively, will soon become available to public.